Explore the Best GA Hard Money Lenders for Real Estate and Investment Financing

Explore the Best GA Hard Money Lenders for Real Estate and Investment Financing

Blog Article

The Ultimate Overview to Finding the most effective Hard Cash Lenders

From examining lending institutions' online reputations to contrasting interest prices and costs, each step plays an essential duty in protecting the ideal terms possible. As you consider these factors, it ends up being apparent that the course to recognizing the appropriate hard cash lending institution is not as straightforward as it may seem.

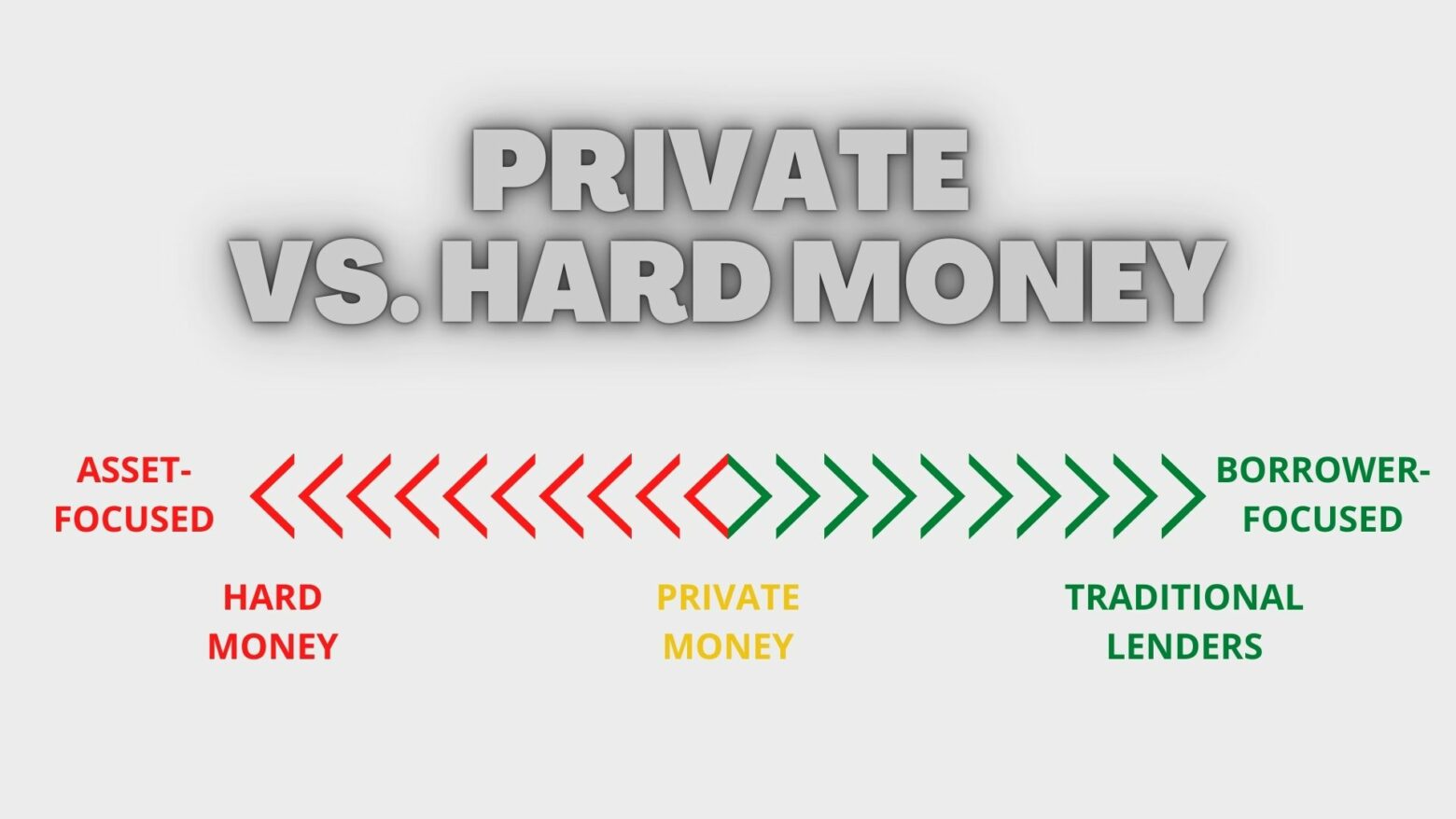

Understanding Difficult Cash Lendings

One of the specifying functions of hard money finances is their dependence on the worth of the residential or commercial property instead than the borrower's creditworthiness. This enables debtors with less-than-perfect credit score or those seeking expedited financing to gain access to resources more conveniently. Additionally, hard money lendings generally include higher rate of interest rates and shorter payment terms contrasted to standard financings, mirroring the increased risk taken by lending institutions.

These financings serve different functions, including funding fix-and-flip jobs, refinancing troubled residential properties, or supplying resources for time-sensitive chances. Because of this, recognizing the nuances of tough cash loans is important for financiers who aim to utilize these economic instruments efficiently in their property ventures.

Trick Elements to Consider

Different lenders use differing interest prices, charges, and settlement timetables. Furthermore, take a look at the lender's financing speed; a speedy authorization procedure can be important in competitive markets.

One more crucial variable is the loan provider's experience in your particular market. A lender familiar with regional conditions can provide important understandings and may be more versatile in their underwriting process.

How to Examine Lenders

Evaluating hard money lenders entails an organized method to guarantee you select a partner that aligns with your financial investment goals. Beginning by examining the lender's track record within the sector. Search for reviews, reviews, and any kind of readily available scores from previous clients. A credible lender needs to have a background of effective transactions and a strong network of pleased customers.

Following, take a look at the lending institution's experience and field of expertise. Various loan providers may focus on different kinds of buildings, such as residential, industrial, or fix-and-flip jobs. Select a lender whose proficiency matches your financial investment strategy, as this expertise can substantially influence the authorization process and terms.

One more vital variable is the lender's responsiveness and communication style. A trustworthy lending institution should be prepared and easily accessible to address your inquiries thoroughly. Clear interaction during the analysis process can indicate just how they will manage your finance throughout its duration.

Finally, guarantee that the lending institution is transparent about their requirements and processes. This consists of a clear understanding of the documentation needed, timelines, and any type of problems that may apply. When picking a hard money lender., taking the time to assess these aspects will certainly empower you to make an educated choice.

Contrasting Rates Of Interest and Fees

A thorough comparison of rate of interest and charges among hard cash loan providers is vital for optimizing your investment returns. Difficult cash financings typically feature higher rate of interest prices compared to typical funding, typically varying from 7% to 15%. Understanding these prices will certainly assist you examine the prospective costs related to your investment.

In enhancement to rate of interest, it is essential to evaluate the linked costs, which can significantly influence the overall financing expense. These fees may include source costs, underwriting costs, and closing costs, typically expressed as a portion of the finance my latest blog post amount. Origination fees can vary from 1% to 3%, and some lending institutions may bill extra costs for handling or management jobs.

When contrasting lending institutions, take into consideration the overall price of loaning, which encompasses both the rate of interest and charges. This all natural approach will permit you to identify the most economical options. Moreover, make sure to ask about any type of feasible early repayment fines, as these can impact your capability to settle the funding early without sustaining added fees. Ultimately, a cautious analysis of rates of interest and costs will lead to more educated borrowing choices.

Tips for Effective Loaning

Understanding rate of interest and fees is only part of the equation for safeguarding a difficult money funding. ga hard money lenders. To make sure successful borrowing, it is essential to thoroughly evaluate your financial situation and task the prospective roi. Begin by clearly specifying your loaning purpose; loan providers are most likely to react positively when they recognize the intended use of the funds.

Following, prepare a thorough company strategy that outlines your task, anticipated timelines, and monetary projections. This demonstrates to lenders that you have a well-thought-out technique, improving your reputation. Additionally, keeping a solid connection with your loan provider can be beneficial; open communication fosters count on and can bring about extra favorable terms.

It is also necessary to make certain that your home satisfies the Our site lender's criteria. Conduct a detailed appraisal and give all called for paperwork to streamline the authorization process. Be conscious of exit strategies to repay the financing, as a clear settlement strategy assures lending institutions of your Find Out More dedication.

Conclusion

In recap, situating the most effective hard cash lending institutions requires a detailed examination of various elements, including lender track record, car loan terms, and specialization in building kinds. Reliable examination of lenders with comparisons of rate of interest and charges, combined with a clear service strategy and strong communication, improves the chance of desirable borrowing experiences. Eventually, thorough study and strategic involvement with lenders can cause successful economic results in realty ventures.

Additionally, hard cash car loans generally come with higher interest rates and shorter payment terms contrasted to standard lendings, reflecting the raised threat taken by loan providers.

Report this page